is 30 year term life insurance good

Term life policies are generally sold in lengths of five 10 15 20 25 or 30 years. A 30-year term life insurance policy is a good option for young people in a lot of different life situations.

What Is A 30 Year Term Life Insurance Policy Selectquote

Term life insurance coverage is a good fit for many people seeking life insurance.

:max_bytes(150000):strip_icc()/Investopedia-terms-termlife-V3-1e8001745dae43aeaa892c04e25d46b1.png)

. Most life insurance providers sell term life policies with term lengths of 10 to 30 years but shorter and longer terms can be found like 40-year terms from Protective and Banner. You are a part of a couple that is laying the groundwork for your future. And the period over which the term insurance coverage is.

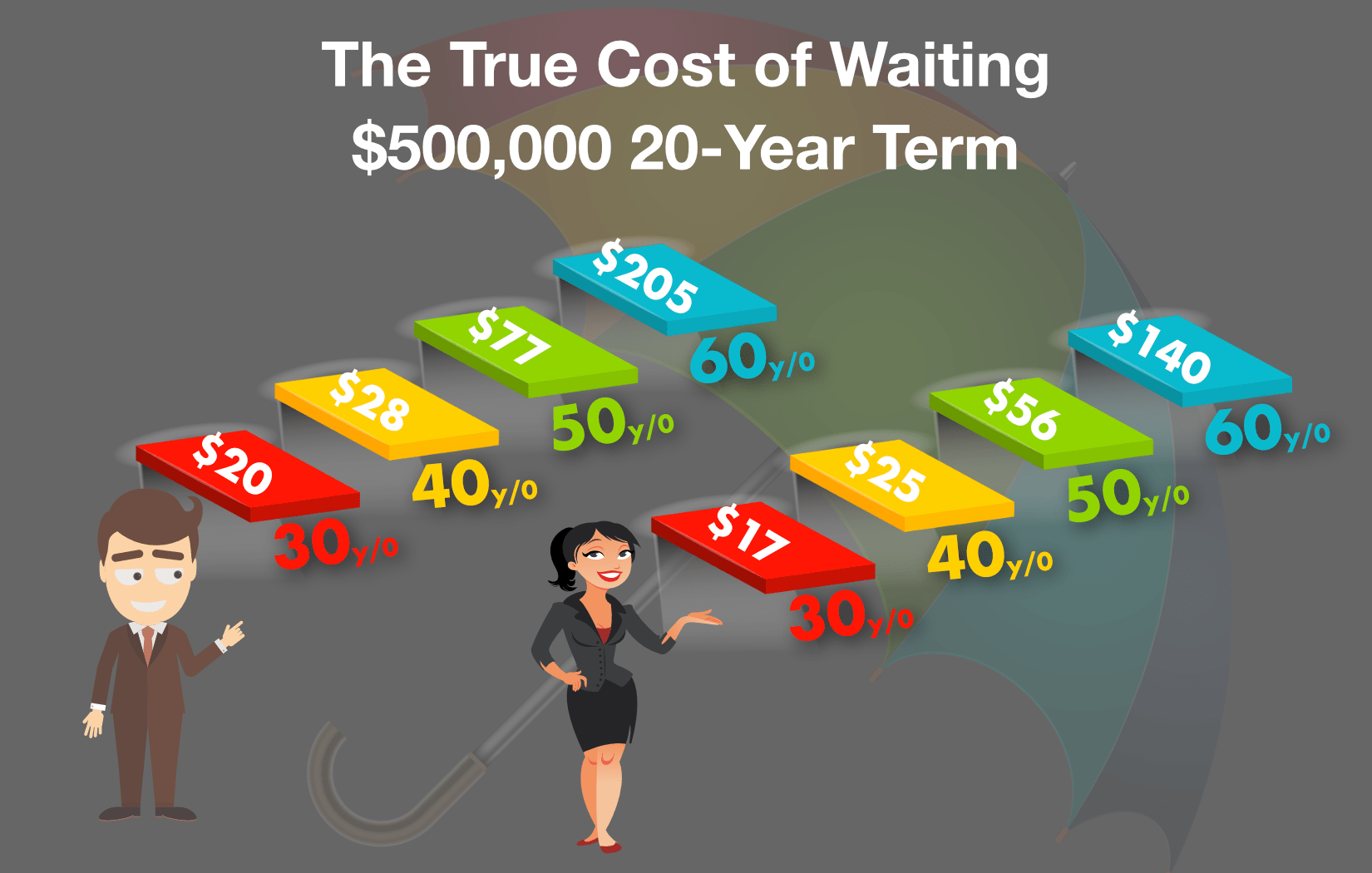

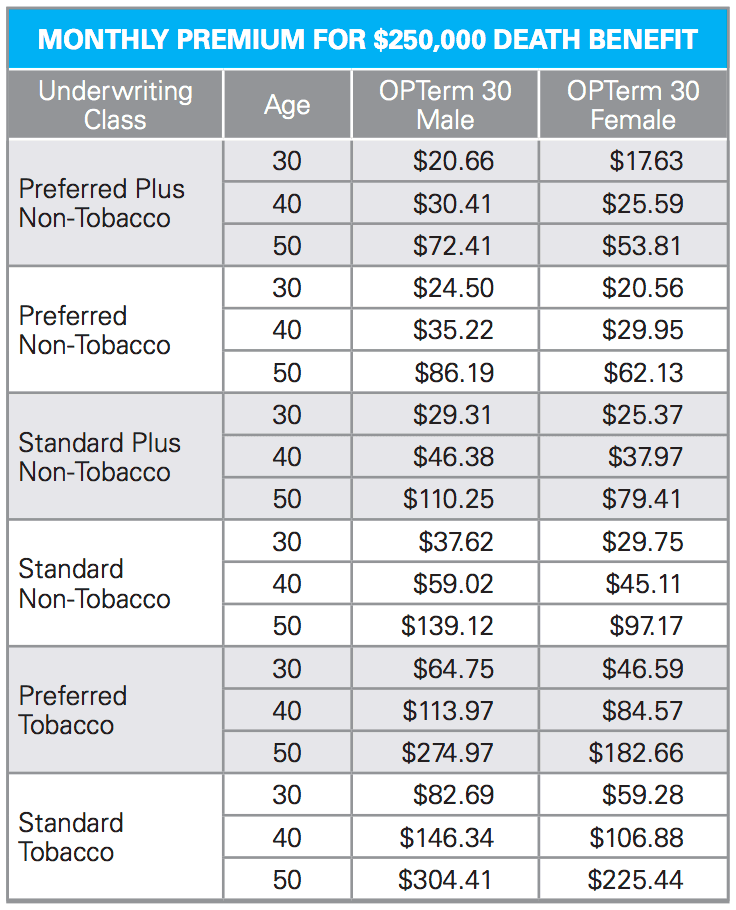

For Males Rates based. Im wondering if this is a reasonable price to pay for the term life insurance or if there are much better deals out there. Most term life insurance policies are for 10 15 or 20 year terms.

In a term insurance plan the life cover is only valid for a specific period. Investing in a life insurance policy is an important decision with long-term consequences good or bad. By definition term life insurance is considered to be temporary.

Your level term policy will only last for a specific period of time such as 5 15 or 30 years. Life insurance averages are based on a composite of policies offered by Policygenius from AIG Banner Brighthouse Lincoln Mutual of Omaha Pacific Life. Below well give you some examples of the kinds of prices you can expect for your monthly premiums on a 500000 30 year term life insurance policy.

As we mentioned 30-year term life insurance is a policy that provides coverage for a period of 30 years. The longer the policy the higher your life insurance. Insurance providers use your age coverage amount smoking history and overall health to determine your premiums.

30 year term life insurance quotes term life insurance rates chart by age 30 year term life quote 30 yr term life 30 year term life insurance cost term life insurance rates 20 yr term life. However more and more insurance companies are now offering a 30 year term life insurance policy. Your monthly premium and death benefit remains fixed for the length of the policy.

A 30-year term life insurance policy can be a great option for younger adults that are in. By definition term life insurance is considered to be temporary. Dont lose your life insurance also.

This is why it is known as term insurance. For example here are the average rates for policies with. New kids new jobs new homes more stress.

The benefit of this type of policy is that it is typically less expensive than. 20-year or 30-year 500000 term life insurance policy. In some cases you can find 40-year term life insurance.

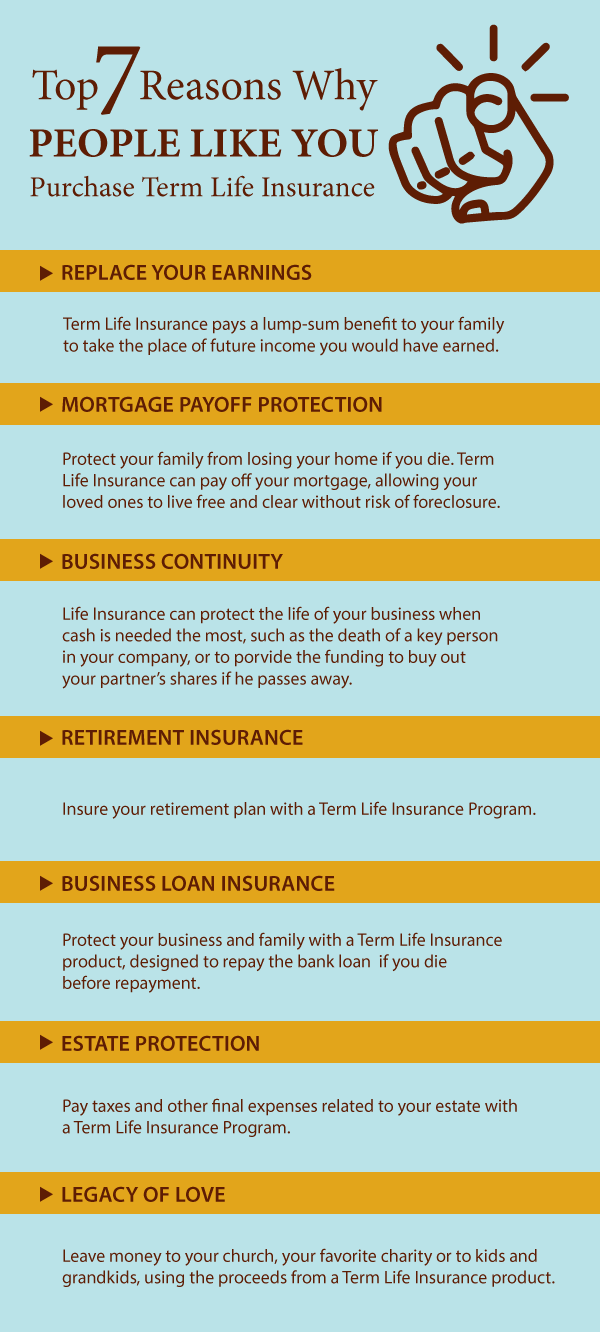

Some features that make term beneficial are. Get a flat 30 year term. Life Insurance Infographic Visually Life Insurance Facts Life.

Who Needs A 30 Year Term Life Insurance Policy

:max_bytes(150000):strip_icc()/dotdash-ask-answers-205-Final-7a1ca51b85d44e0d81dc7b46f919180d.jpg)

Term Vs Universal Life Insurance What S The Difference

Term Vs Whole Life Insurance Differences Pros Cons Nerdwallet

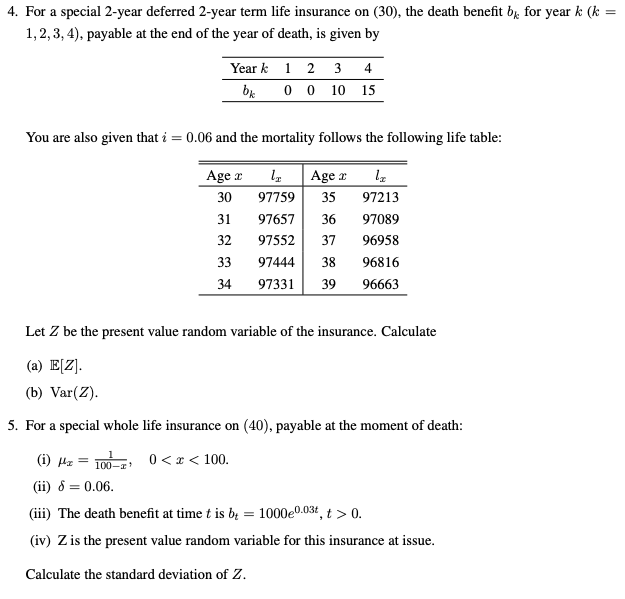

4 For A Special 2 Year Deferred 2 Year Term Life Chegg Com

Top Pro Tips To Getting The Best 30 Year Term Life Insurance Program

How Much Does 30 Year Term Life Insurance Cost

Term Life Insurance Rate Chart By Age Effortless Insurance

30 Year Term Life Insurance With No Exam Carriers Rates

How Much Does 30 Year Term Life Insurance Cost 2022

Comparing Term Life Vs Whole Life Insurance Forbes Advisor

Infographic Affordable Life Insurance More Common Than Most People Think

20 Year Term Or 30 Year Term Life Insurance Which Is Best Jrc Insurance Group

Choosing A Life Insurance Term Length

What Is A 30 Year Term Life Insurance Policy Selectquote

30 Year Term Life Insurance Archives The Annuity Expert

How Much Does 30 Year Term Life Insurance Cost

Best 30 Year Term Life Insurance Quotes By Age

Best 30 Year Term Life Insurance Rates Compare Top Companies